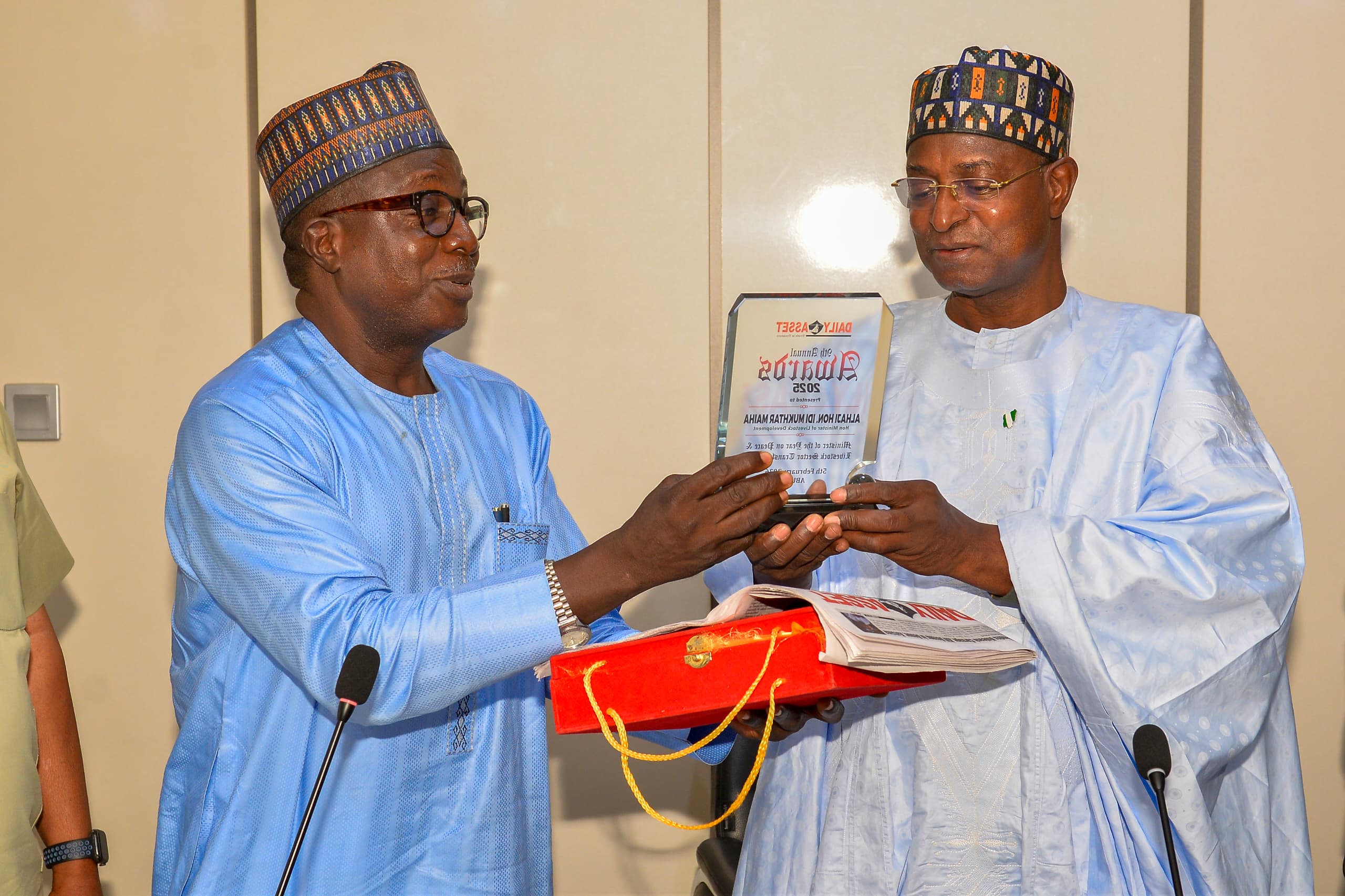

Image Gallery:

Mukhtar Advocates Access to Finance for Livestock Farmers

The Minister of Livestock Development, Idi Mukhtar Maiha, has called for deeper stakeholder collaboration to improve access to finance for youth and women engaged in livestock agribusinesses across Nigeria.

Maiha made the remarks while delivering a goodwill message at a high-level policy dialogue convened by the African Development Bank (AfDB) in Abuja on Monday 4th August 2025, under the theme: “Access to Finance and Empowering Youth and Women for Agribusiness Success.”

Addressing a cross-section of policymakers, development partners, financiers, and agripreneurs, the Minister emphasised the importance of financial inclusion, asset support, and market linkage for rural livestock farmers.

“According to the Enhancing Financial Inclusion and Access (EFInA)`s Access to Finance (A2F) Survey, formal financial inclusion in Nigeria increased from 56 percent in 2020 to 64 percent in 2023.

"However, 26 percent of Nigerians are still financially excluded, which means 28.8 million adults are not part of the financial system...Financial exclusion is pervasive in rural areas due to illiteracy, low penetration by banks & fintech, sociocultural attitudes and poor infrastructure," he noted.

Speaking further, Maiha disclosed that the Ministry of Livestock Development is scaling up interventions to empower 37,000 young men and women with practical training, starter assets, and sustainable access to markets.

"We have developed and are implementing the Nigeria Livestock Growth Acceleration Strategy (NL-GAS) with a goal of revolutionizing the sector and increasing it from a $33billion to $74billion industry within the next 5years.

"The ten pillar NL-GAS has two pillars that are the two main areas of discussion here today, these are Finance & Insurance and Women & Youth Initiative. We are collaborating with different actors to ensure that our farmers and other stakeholders are financially included in all sectors such as dairy, small ruminant, poultry and rural trade," the Minister stated.

He urged the AfDB and other partners to design financing windows that reflect the realities of the livestock ecosystem. Drawing attention to the need for targeted policy reforms, Maiha noted that strengthening credit guarantees and cooperative-based lending models could help unlock the potential of informal livestock actors.

Additional goodwill messages were delivered by prominent dignitaries including the Special Adviser the the President on Livestock Development, Professor Attahiru Jega; the Chairperson, Nigerians in Diaspora Commission, Abike Dabiri-Erewa; and Ministers of Youth Development, Budget and Economic Planning, Senator Atiku Abubakar Bagudu and Agriculture and Food Security, Senator Abubakar Kyari, among others.

Earlier in his welcome address, Dr. Abdul Kamara, AfDB Country Director for Nigeria, highlighted the Bank’s strategic approach to agribusiness transformation and the need to tailor financial solutions to fit vulnerable groups.

“Our objective is not just about giving out loans; it is about designing inclusive, adaptive financing mechanisms that empower women and youth where they are and with what they have.”

“Only 11.4 percent of Nigerian businesses access credit through banks. The rest rely on informal lending, if any. This presents a serious developmental constraint.

“With the Investment in Digital and Creative Enterprises (I-DICE) programme and other value chain-specific projects, AfDB is prioritising smart agribusiness investment to enable employment and scale local food systems.”

On his part, the Minister of Agriculture and Food Security in his keynote address, called for accelerated adoption of innovation and local value retention through public-private investments.

“We cannot continue exporting raw produce while importing finished products. If we want true empowerment, we must fix the value chains, especially financing, processing, and certification.”

“Young Nigerians are already innovating in precision farming and AI-driven agriculture. The challenge now is capital and trust,” Kyari noted, adding, “under the National Agricultural Technology and Innovation Policy (NATIP) agenda, we are fostering a new generation of agri-entrepreneurs who will create wealth, jobs, and food security,” Kyari said.

Throughout the event, speakers and participants reaffirmed the need to deepen access to affordable and flexible financing for youth and women in agriculture, as well as leverage innovation and technology for productivity, value addition, and job creation.

As Africa’s youth population continues to rise, with Nigeria expected to surpass 400 million people by 2050, stakeholders agreed to close the gender and youth gap in agrifinance through targeted policies and investments.

Ben. Bem Goong

Director, Press and Public Relations Department

4th August, 2025

Comments on Post (0)